Legal & Regulatory Framework

PPP® MEMORANDUM

| To: | Business Owners & Incorporated Professionals Receiving T4 Income |

| CC: | Accountants Specializing In Helping Business Owners & Incorporated Professionals |

| From: | INTEGRIS Pension Management Corp. (INTEGRIS™) |

| Date | January 7 2022 |

| Re: | Advantages of Establishing a Personal Pension Plan™ (or PPP®) through the corporation |

This memorandum sets out the legal framework that gives business owners and incorporated professionals access to a form of retirement savings vehicle that is superior to the Registered Retirement Savings Plan (“RRSP”). The type of plan considered here is the Personal Pension Plan™ (PPP ®). The PPP ® is designed for the business owner (and perhaps his or her family if they also work for the business). It does not need to be offered to the employees of the business – hence the term “Personal”.

While a PPP® can also be offered to non-shareholders executives of larger companies this Memorandum focusses on owner-operators that are considered ‘connected persons’ under income tax laws in Canada.

Since this memorandum provides information of a general nature, you should consult with your financial, accounting or legal advisors and ask them to carefully review this information and contact INTEGRIS™ should any questions arise as part of the due diligence process. [1]

CONTENTS

1. Executive Summary

2. Legal Framework for Personal Pension Plans

3. Tax Advantages & Considerations

4. Special Tax Applications

5. Creditor Protection Features

6. Investment Flexibility

7. Fiduciary Oversight

Appendix A

1. EXECUTIVE SUMMARY

Since 2014 Canadian business owners and incorporated professionals can create true pension plans for themselves, putting them on par with teachers and civil servants when it comes to generous retirement savings. The plan in question is the Personal Pension Plan™ or PPP ®. As compared to an RRSP, the PPP ® offers seven (7) additional ways of reducing taxes while contributing more towards retirement, all through a tax-deferred savings plan. By comparison an RRSP only offers a single annual deduction (18% of earned income capped by the RRSP limit of that year.)

The PPP®’s assets are not invested by INTEGRIS™ but remain under your control through the investment advisor you have selected to assist you in meeting your retirement goals. The assets are also custodied and reside with the financial institution you have selected through your financial advisor. Examples of varied financial institutions that allow the PPP® include: Accilent Capital Management Inc. Aligned Capital Partners Inc., CI Direct, Connors Clark and Lunn, Industrial Alliance Insurance and Financial Services, Highview Financial, MacNicol and Associates Asset Management Inc., Manulife Securities, Newport Private Wealth Inc., RBC Dominion Securities, Richardson GMP Ltd, Scotia Wealth, TD Wealth, Vector Global Canada etc.

Because the PPP® allows a member to contribute well in excess of the RRSP maximum limits, the advantages are two-fold: (1) an ability to claim much larger tax deductions and (2) an ability to compound more money in a tax-deferred account until retirement. Assets of a PPP ® are creditor-protected and in certain circumstances can even be passed down to the next generation on a tax-deferred basis, unlike shares of companies or assets in an RRSP. The PPP ® can also help qualify a business being sold for the lifetime capital gains exemption. The PPP® also benefits from other preferential tax treatment in. number of important situations. [2]

Finally, because monies inside of a pension plan are governed by more flexible investment rules than under RRSPs, certain categories of investments (private equity, mortgages, land etc.) can now be accessed using pre-tax dollars, thereby sheltering their growth from immediate taxation.

To alleviate the complexity surrounding pension plans generally, INTEGRIS™ acts as your delegated plan administrator, taking care of all aspects of the administration of the plan.

The introduction of the Morneau Measures (e.g. Tax On Passive Income) in 2018 further enhances the efficacy of the PPP® as a tax-optimizing strategy.

2. LEGAL FRAMEWORK FOR PERSONAL PENSION PLANS

The term “Personal Pension Plan™” is not a term of art, and is not found within the confines of the Income Tax Act (Canada) because it was conceived as a registered trade-mark by INTEGRIS™ to distinguish this particular and innovative plan design from pre-existing and more conventional individual pension plans (“IPP”). The IPP has been regulated through the Income Tax Regulations (“ITR”) since 1990-1991 when specific regulations pertaining to designated plans were adopted in ITR 8515. While the exact number of IPPs is difficult to obtain from Statistics Canada, it is commonly thought that there are approximately 15,000 IPPs in all of Canada at the present time.

PPP ®s, from a legal perspective, are first and foremost registered pension plans and as such are governed in part by Income Tax Act (Canada) section 147.1. The plan structure of the PPP ® is that of a “combination” pension plan offering a business owner/member the option of either accruing retirement benefits using the traditional ‘defined benefit’ accrual method, or the simpler and less expensive ‘defined contribution’ method. (We discuss both methods below in greater detail). In addition, the PPP ® also provides a member with the ability to utilize the ‘Additional Voluntary Contribution’ (“AVC”) rules found in the tax legislation, on a voluntary basis to supplement the assets being contributed on an annual basis.

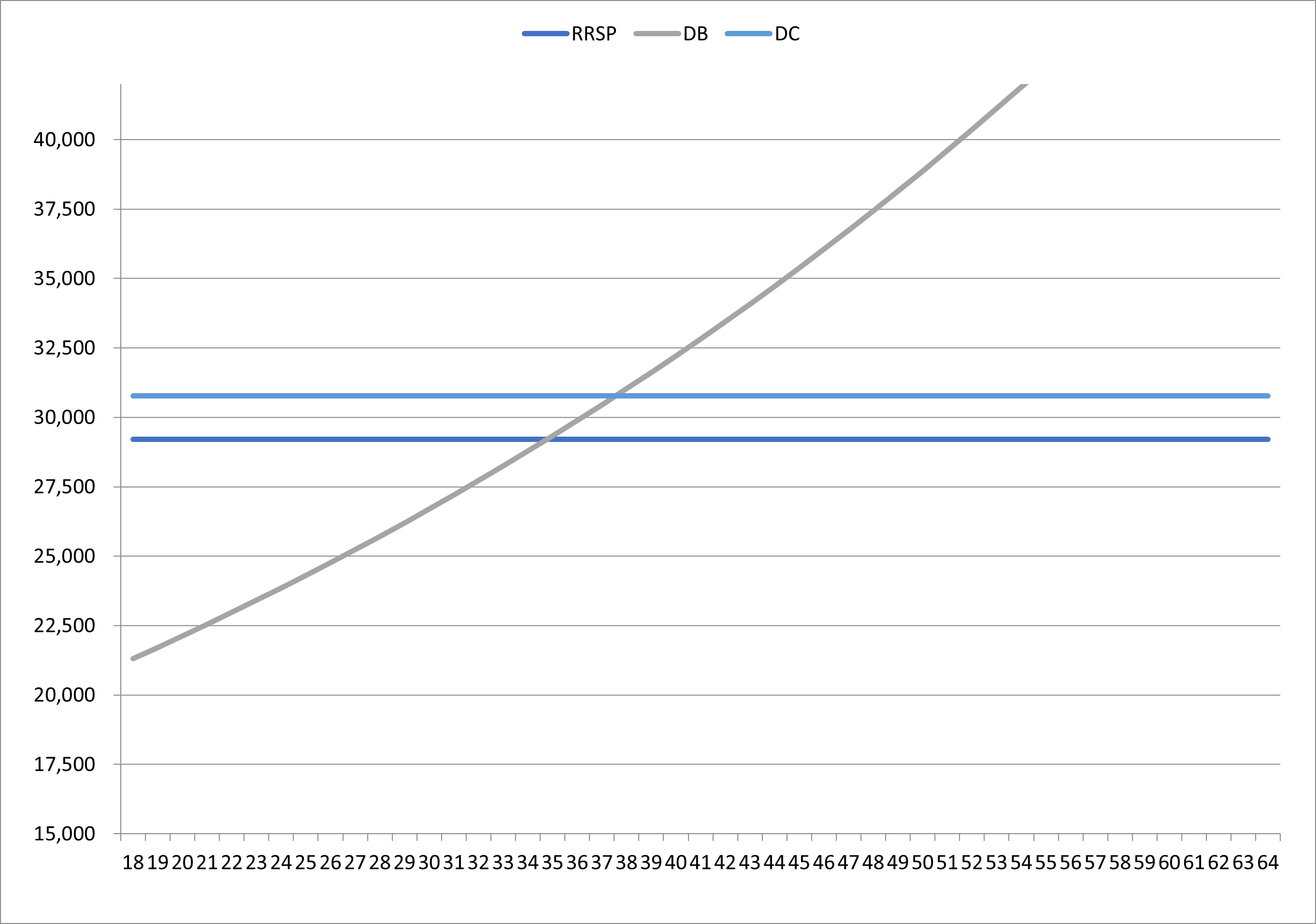

The key difference between ‘defined benefit’ and ‘defined contribution’ stems from the way that the benefit accumulates. The simpler of the two is the ‘defined contribution’ (“DC”) method: similar to an RRSP, annual contributions are made to the pension fund based on a percentage of salary These DC contributions accumulate and are invested within the pension fund and the growth is exempt from taxation until monies are withdrawn from the plan (typically at retirement). There are limits to the annual DC contributions permitted and this is referred to in tax legislation as the “money purchase limit”. The 2022 money purchase limit is set at $30,780. This means that the limit is reached when the pensionable salary (T4 income) paid by your corporation reaches $171,000.[3] The tax act will not provide further tax assistance to accumulate a pension in a registered pension plan on pensionable income above that $171,000 limit. (To tax shelter more, one must use other strategies like a Retirement Compensation Arrangement - for example.)

The ‘defined benefit’ (“DB”) rules are quite different. Here, the amount of benefits payable at retirement is determined by a formula [4]. The DB pension is therefore a promise that must be met by setting assets inside the pension fund, and growing those assets until retirement. The law requires that an actuary be used to calculate the contributions required in order for the pension fund to have sufficient assets at retirement to pay the promised DB benefit. Thus, the way to determine the contributions is more complex than under the simple DC method. ITR 8515 does set out some assumptions that the actuary must take into account in calculating the required contributions. One of these assumptions is that the assets contributed to the pension fund grow at 7.5% (whether or not this occurs in actual fact.) The 7.5% assumption is discussed below in the context of tax deductions for “special payments”.

To round out the structure of the PPP ®, a third account, the ‘additional voluntary contribution’ (“AVC”) subaccount forms part of the plan design. This AVC account allows for the tax-deferred transfer of RRSP assets and is not permanently ‘locked-in’ by pension legislation, making the funds in it accessible at any time to the business owner. Employee contributions can be made on a voluntary basis to the AVC account as well during the year, triggering a personal tax deduction for the plan member.

One of the key advantages of the PPP ® design is that it provides flexibility with respect to the amount of contributions made each year: in good years, a business owner might utilize the DB component of the PPP ® to tax-deduct as much as possible. In lean years, the same business owner may elect to save under the DC component and reduce contributions to a mere 1% of salary. When business subsequently picks up again, the member could look back to the years where contributions were small and retroactively effect a “buy back of past service [5]”, thus creating additional contribution room. This is particularly useful for non-connected plan members such as highly paid executives of large companies. When it comes to the advantages to connected plan members, the PPP® triple account architecture provides taxpayers the ability to tax shelter significantly more than under an IPP over one’s lifetime. More on this topic can be found in a special memorandum dedicated to the differences between the IPP and the PPP®.

Assets contributed to the PPP ® are invested within the pension fund set up for the plan. See Section 6 below for more details on pension investments.

The Morneau Measures were designed, in part, to dissuade business owners from using the small business deduction and low corporate tax rate (12.2% in Ontario on the first $500,000) to invest passively any excess capital not required for the operations of their company. In addition to imposing conditions on dividend and income splitting with non-active family members, these measures claw back the $500,000 small business rate allowance on a 1:5 basis once passive investments exceed $50,000 in the operating company or any associated company (which would normally capture so-called “Holding” companies.)

Thus, a business owner who has accumulated significant capital in holding companies and plans on a ‘status quo’ strategy will soon face a reduction in the amount of active business income taxed at the low rate (and thus face tax hikes). The PPP® provides a legitimate way of moving passive corporate investments that are not only currently taxed at the much higher passive rate, but also have the effect of exposing more active business income to the general corporate tax rates, into a tax-deferred vehicle.

3. TAX ADVANTAGES & CONSIDERATIONS

Pension plans have long historical roots in tax legislation. The very first income tax statute adopted by Parliament during the First World War already provided for tax assistance with respect to pension plans. By contrast, the rules surrounding Registered Retirement Savings Plans only date back to 1957.

As such, it is well understood that registered pension plans are more generous from a tax assistance point of view than RRSPs. In this section, we review the various tax deductions available to a PPP ® member and his or her corporation, that are non-existent within the RRSP context. The tax deductions can be classified as ‘one-time’ deductions or ‘ongoing deductions’. Moreover, the deduction is claimed by the person making the contribution, thus some PPP ® contributions are personally tax deductible whereas others trigger corporate tax deductions. Since a corporation is taxed differently whether it is under the Small Business Deduction level (approx. $500,000) or above it, or if it is a personal service corporation, the level of tax assistance provided by these pension deductions will vary accordingly.

The table below summarizes the additional tax deductions that PPP ®s offer to business owners beyond the tax assistance permitted under RRSPs:

Type of Deduction | Application | Who Claims the Deduction? | Typical Amount of Deduction |

|---|---|---|---|

Buy Back of Past Service

| Used to fund the cost of enhancing the pension benefits promised to the member by retroactively ‘buying back’ years of credited service. | Corporation. Can be amortized over time. | $30,000 - $200,000 |

Terminal Funding

| Used to fund the cost of enhancing the pension benefits of a member who decides to retire early and seeks to index the benefits to inflation. | Corporation. Can be amortized over time. | $55,000 - $1,000,000 |

RRSP Double Dip

| In the year that the PPP ® is established, Member can claim a deduction for the PPP ® and their RRSP | Member. | $6,540 to $26,230 (Will depend on income of Member in the year 1990, if any) |

Annual Contributions [6](current service cost) | Contributions exceed the RRSP maximum limits every year and keep growing with age. | Corporation, but could also be 50% Member and 50% Corporation. Special rules for DC account. |

$1,570 to $21,349 more than the RRSP Max. |

Deductions for fees (including Investment Management Fees) |

Permitted under

Income Tax Act | Corporation. | Varies with quantum of fees under the plan. |

Interest on borrowed funds to contribute to PPP ® | Permitted under Income Tax Act, under general interest deduction rules | Corporation. | Varies with quantum of interest paid to lenders (if any) |

Special Payments (every 3 years) | Applicable when assets in the DB component of the PPP ® do not yield the prescribed 7.5% rate of return expectation. | Corporation. | Grows with the size of the liabilities and depends on actual rate of return of assets in pension fund. |

It is not uncommon in many circumstances to discover that a private corporation can claim $500,000 to $900,000 more tax deductions than an individual saving through an RRSP over a 20 year time-frame. This level of additional tax assistance, coupled with some of the special tax applications listed below, provide the PPP® with the distinction of being the most tax-effective retirement savings solution permitted by the Income Tax Act (Canada).

4. SPECIAL TAX APPLICATIONS

In addition to these new tax deductions (that are unavailable to RRSP savers), the PPP ® also offers four (4) supplemental special tax planning strategies described below – each one capable of saving clients and their families substantial sums of money.

GST/HST Pension Entity Rebate

The corporation setting up the PPP ® can claim the GST/HST Pension Entity Rebate (“Rebate”) under section 261.01 of the Excise Tax Act by filling out a CRA Form 4607. This Rebate gives the corporation a rebate of 33% of all HST paid in connection with the PPP ®. Over time, using this Rebate can provide substantial additional savings. The Rebate applies to PPP ®s using a trust platform. PPP ®s that use an insurance platform do not rely on the Rebate, rather they can claim input tax credits for any GST or HST paid in connection with the PPP ®. In effect, on the insurance platform, the PPP ® is HST-free to the company.

Lifetime Capital Gains Exemption

Where a corporation is sold through a share transaction and where to qualify for the Lifetime Capital Gains Exemption (approx. $892,218 in 2021), the corporation must be ‘purified’ of non-active business income assets, the use of Terminal Funding and Buy Back of Past Service can be utilized. This not only allows the individual to claim the lifetime capital gains exemption, it also gives the corporation a tax deduction in the process thereby keeping more money in the client’s hands (through their corporation).

Inter-generational tax-deferred wealth transfer

Where family members working in a family business participate in a single family PPP ®, upon the death of retired family members, PPP ® assets earmarked to fund the stream of pension benefits become surplus. The plan provisions can stipulate that any surplus in the pension plan belongs to the surviving plan members in order to fund their own pension benefits. Thus, instead of dealing with an RRSP “deemed disposition” and/or any probate fees, the same family members can pass wealth from one generation to the other without any immediate tax consequences. Obviously, taxes will eventually be owing on any pension benefits paid out to the surviving children/plan members when they reach retirement. [7]

5. CREDITOR PROTECTION FEATURES

Like all formal registered pension plans in Ontario (and in most provinces with pension legislation) the PPP ® is provided with the highest level of creditor protection in Canada. The assets of the pension plan cannot be seized by creditors of the plan member (except spousal creditors under Family Law legislation) nor of the corporation sponsor. For most RRSPs in Ontario, this is not the case in the normal course.

Moreover, the annual contributions required of the company to the pension plan receive ‘super priority’ in the event of the insolvency of the corporate sponsor, and rank above the claims of secured creditors like major commercial lenders. This extra protection was granted after recent changes (2008) were made to the federal Bankruptcy and Insolvency Act.

6. INVESTMENT FLEXIBILITY

Pension plans in Canada, for the most part, are governed by the ‘federal investment rules’, a set of regulations adopted by the federal government under its pension legislation the Pension Benefits Standards Act, 1985. The restrictions imposed on how pension plans are invested relate mainly to concentration limits and to related party transactions. Self-dealing is not permitted, in the sense that a pension plan set up by a corporation cannot use the monies in the pension fund to then invest in buying shares of the corporation that set up the plan. Also, to avoid over-concentration in any particular investment, no more than 10% of the pension fund may be invested in any one security (e.g. Shares of a tech company, or bank).

However, unlike RRSPs, PPP ®s can invest in certain asset classes that would not always be considered “RRSP-eligible”. For example, units of private partnerships that don’t qualify for RRSPs would be an eligible investment for a PPP ® (assuming the concentration and related party rules are followed). Thus, private equity, real estate and mortgages are types of PPP ® asset classes that are typically not found in vanilla RRSPs – or if they are, those are subjected to a variety of limitations.

One example of investment flexibility would be the ability to invest in Private Real Estate such as multi-unit residential buildings offered via rentals through strategic partners like Golden Equity Properties Ltd.

7. FIDUCIARY OVERSIGHT

For most small business owners, adopting a pension plan is seen as too complicated. This ‘barrier to entry’ has an unfortunate consequence in that it forces the business owner to rely on the less tax-effective RRSP. Pension plans are complex legal concepts and do require professional assistance to be properly maintained. This is why under a Personal Pension Plan™, the business owner’s corporation would appoint INTEGRIS™ as its ‘delegated’ plan administrator to be responsible for the registration, administration and compliance aspects of the PPP ® on a go-forward basis. Included in this bundle of services would be any actuarial valuation costs. This appointment of INTEGRIS™ as an agent is done through an Agency Agreement.

Under the Pension Benefit Act, the agent (INTEGRIS™) of the plan administrator (the corporation) is held to the fiduciary standard of care. In other words, INTEGRIS™ must act in the best interests of the client in order to avoid legal repercussions. A fiduciary is someone the law recognizes as having a special duty of care towards a beneficiary (the Member, in the case of a PPP ®.)

This legal obligation sets INTEGRIS™ apart from most other financial institutions, where there is no special protection granted and where the member is deemed to be looking after their own interests. In practical terms, the fiduciary duty translates into concrete steps in a variety of ways. For example, INTEGRIS™ acts as a buffer between the business and the governmental regulatory bodies that supervise the pension plan, such as the Registered Plans Directorate of the Canada Revenue Agency (“CRA”). Another example, is that INTEGRIS™ routinely finds ways to generate economies of scale from the service providers that offer the PPP ® to their clientele. Fee reductions are common because of the bulk purchasing power of INTEGRIS™ when it deals with organizations, groups of businesses or associations.

INTEGRIS™ also provides extensive pre-sale and post-sale support to the clients and financial advisors who might be investigating whether to upgrade from an RRSP or an IPP into a PPP ®. Given the technical nature of pension laws, the combined 150 years of pension law expertise of INTEGRIS™ provides education at the critical point when a decision is being made regarding retirement planning.

Finally, for individuals seeking to have a corporate trustee hold the assets of their PPP ® in trust (instead of the traditional 3 individual trustee configuration prevalent in the industry since 1991), INTEGRIS™ does offer clients the option of appointing iA Trust Inc. as corporate trustee of the PPP ® at a very low cost. Financial advisors can use their current Custodian of assets under this corporate trust structure. No other providers of IPPs in Canada can offer this special service, thereby alleviating the need to secure the services of third parties to act as trustees.

The PPP ® is also a tool in a wider toolkit of tax planning strategies that help business owners keep more of their hard-earned money. The tax savings generated by the seven (7) additional tax deductions offered by the PPP ® could be used to purchase a corporately-held universal life (“U/L”) exempt insurance policy (see section 148 of the Income Tax Act (Canada). U/Ls are beyond the scope of this memorandum.

APPENDIX ‘A’

Chart 1: Annual (2022) Tax Contribution Limits Depending on registered vehicle (RRSP vs DC vs DB)

[1] Advisors interested in reading a detailed review of the rules surrounding pension plans in the small business context should consult M.E. Gosselin and J.P. Laporte (2013) A Review of Individual Pension Plans Canadian Tax Journal Vol. 61

[2] The assets of the plan are not subjected to the ‘departure tax’ when a plan member becomes a non-resident of Canada. The contributions made by the sponsor of the plan are not caught by the Tax on Passive Income introduced in 2018. The capital removed from the sponsor’s balance sheet purifies that Small Business Corporation to trigger the lifetime capital gains exemption. The income paid out of the pension plan benefits from pension-income splitting treatment at any age etc. Each of these can add significant value to the overall retirement strategy.

[3] We note in passing that the DC limit is $1,570 higher than the RRSP limit in 2022.

[4] Typically, the formula used is: 2% x years of credited service x Final Average Earnings. Thus, someone contributing for 30 years, and ending his or her career with a salary of $100,000 would be entitled to an annual retirement pension of $60,000 until death, continuing on to the surviving spouse.

[5] The concept of ‘buying back past service’ is further discussed in Section 3.

[6] See Chart 1, at Appendix “A” for a comparison of the various tax contribution limits for 2022.

[7] While taxable in retirement, it should be pointed out that pension benefits are eligible for pension income-splitting and furthermore that the first $4,000 of pension income paid each year is ‘lightly taxed’ because of the non-refundable pension amount credit that can be claimed on personal tax returns where pension income-splitting is utilized.

PPP ® is a registered trade-mark of INTEGRIS Pension Management Corp.